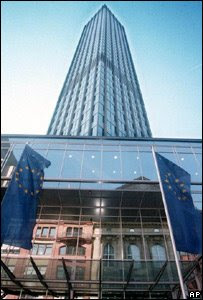

The European Central Bank (ECB) in Frankfurt has been celebrating its 10th birthday this year. But as Chris Bowlby discovered, the bank's troubled plans for a new headquarters could be a portent of tricky times ahead.

European Central Bank

The ECB is responsible for the monetary policy of 15 countries

I had expected a grand approach road, rows of expensive cars and smartly suited security guards, but what I first noticed were the rabbits.

Just in front of what I had been told was the Euro Tower - the European Central Bank's main building in the centre of Frankfurt - is a simple park with benches, shrubs and, yes, happily nibbling rabbits.

Was this really it?

A garish plastic sign in the shape of a Euro standing incongruously among the shrubs suggested I had come to the right place.

But as I wandered around the streets at the base of the tower, all I could see was the entrance to a cafe, an amusement arcade with slot machines and what looked like a laundrette.

Then, at last, an entrance of sorts behind swing doors and a little shop advertising itself as a visitor centre.

Anxious memories

Virtually deserted it sold a strange selection of gifts including, for the really keen, the memoirs of the bank's former chief economist, Otmar Issing, and plastic bags filled with what looked to me like bedding for pet animals.

It was, the shopkeeper said, in fact the shredded remains of thousands of bank notes taken out of circulation.

The very modest style of today's Euro Tower continues that tradition of deliberately low-key central banking

He assured me earnestly that such bags were very popular with foreign tourists.

But not, I suspect, with Germans, who have very long and anxious memories when it comes to the destruction of money.

For decades Germany's severe anti-inflationary policy was based on folk memory of the hyper inflation of the 1920s Weimar Republic, which disastrously undermined political and social stability.

Or the years at the end of the Third Reich, when the only valuable currency was cigarettes.

And that anxious memory fed into the deliberately low-key style of post-war German central banking.

The Bundesbank, when it ran the Deutschmark, was always housed in modest offices in a Frankfurt suburb.

Jean-Claude Trichet, president of the ECB

Jean-Claude Trichet has been president of the ECB since 2003

And once when I went to see its former head, Helmut Schlesinger, who lived in a suburban house and often went to work on public transport, he told me he felt most accountable to the residents of his home village in southern Germany.

They would wag their fingers at him when he came to visit and ask: "Helmut, are you still looking after our money properly?"

So the very modest style of today's Euro Tower continues that tradition of deliberately low-key central banking and - whisper it elsewhere in Europe - symbolises what is still a very Germanic monetary policy.

And attempts are being made to pass the policy onto younger generations.

The bank's educational materials feature a trendy young couple, Anne and Alex, vanquishing an ugly inflation monster as they learn that price stability will enable them to buy more CDs.

Economic prospects

This approach worked well in the first 10 years of the European bank's existence as the economic climate has generally been favourable for all Europeans.

But as economic prospects worsen, there is an uneasy feeling that the supposed monetary solidarity that binds the single currency's 15-member states will be tested more severely than ever.

And if the bank itself wanted uncomfortable proof of this new era, it has found it while trying to move up in the property market.

Whatever the bank may say about its anti-inflationary zeal, prices for building materials are shooting up

As I left the visitor centre and its strange souvenirs, I noticed a video screen mounted on a wall with eye catching images of a new sky scraper.

This - the commentary proudly stated - would, in a few years, be the bank's new home.

Following its first successful years there were perhaps some among the bank's multi-national management who felt that a rather more striking HQ was appropriate.

Land was bought - the current Euro Tower is merely rented - and an architectural competition was held.

The Austrian winners, who had clearly been on a central banking course in baffling jargon, promised a multi-faceted building structure with the economical topology of a double slab high rise.

On hold

But what has been far from economical is the cost of trying to build it. When the bank tried to find a builder none came forward with a remotely acceptable price.

Whatever the bank may say about its anti-inflationary zeal, prices for building materials are shooting up.

Major building firms, global players these days, apparently believe that in the current economic climate they will make much more profit in say the Middle East than in Europe.

European Central Bank

The bank is based in Frankfurt, the Eurozone's largest financial centre

So embarrassment all round, as the bank's relocation plans have had to be put on hold.

The Italian and French governments - who like grand public sector projects and favour looser monetary policy to counteract economic downturn - might have advised the bank just to borrow the extra and go ahead anyway.

They like the idea that the European Central Bank is going to become a bit less strict in its policies as Europeans try to weather the current economic storm.

But I suspect that many Germans are quite pleased that whatever the economic weather the bank will remain for now in its modest, reassuring home, with contented rabbits down below, anti-inflationary hawks perched in the offices above.

And Europe's money managed as cautiously and consistently as possible.

No comments:

Post a Comment